Brain dysfunction causing anxiety, depression, ADHD, PTSD, as well as symptoms of addiction can be diagnosed and treated with Neurofeedback.

EMDR Therapy does not require talking in detail about distressing issues and is designed to resolve unprocessed traumatic memories in the brain.

Ear acupuncture for addictive behaviors has been clinically proven to reduce cravings for alcohol and drugs, minimize withdrawal symptoms, increase calmness, and provide relief from stress and emotional trauma.

Recovery Coaching provides continued peer recovery support for individuals who seek outpatient guidance in their recovery from addictions while reengaging with their lives and careers.

Mind Power is one of the strongest powers you possess. Coming to understand this power can help you identify opportunities and obstacles that can lead to success or failure. Learn success principles and techniques to achieve longterm recovery.

LGBTQ+ focused groups, staff, and housing are available at The Process Recovery Center.

The Process Recovery Drug and Alcohol Rehab Treatment

In New Hampshire

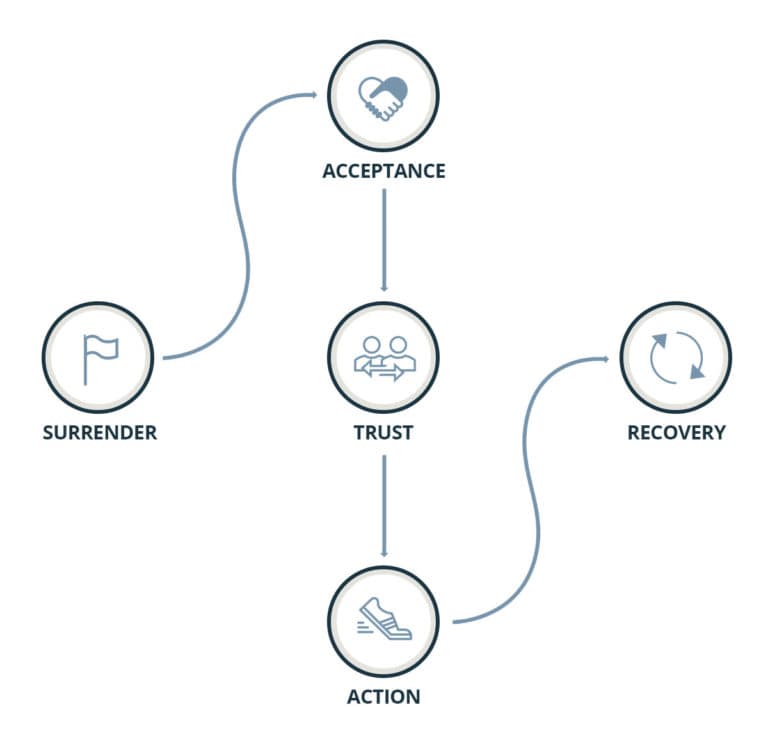

Recovery is a lifelong journey, and The Process Recovery Center is here to support you wherever you are on your path to healing. We provide outpatient services, partial hospitalization programs, and aftercare planning for those with substance abuse disorders. If you or a loved one is struggling with drug or alcohol addiction, speak with a member of our team confidentially to learn more about our treatment options.

Rehab Treatment at

Process Recovery

At The Process Recovery Center, we take a holistic approach to alcohol and drug rehabilitation and offer a wide range of healing tools and therapeutic modalities. Our services include meditation-assisted treatment, behavioral therapy, group therapy, acupuncture, and sober living coordination. Each treatment plan is fully customizable to meet the unique needs of each client.

We are a nationally accredited treatment center committed to the overall quality and satisfaction of all our clients.

Our staff is largely comprised of people in long term recovery who serve as a role models, mentors, advocates and motivators. These individuals share a common aim: teaching relapse prevention and promoting long-term recovery.

We believe in incorporating an array of healthy practices such as yoga, mindfulness, exercise and nutrition. These are important elements of a holistic approach.

We believe that every client is unique and their treatment plans should be as well. Our clinical and recovery team work hard to ensure that every client’s treatment goals are a true reflection of their individual needs.

We have crafted a strong and diverse group of clinicians who believe passionately in evidence based practice and client empowerment.

We provide and coordinate multiple levels of care, as well as sober living, aftercare planning, and recovery resources. We pride ourselves in relieving our clients and families of the stress of figuring out what’s next in their process.

Our Drug and Alcohol Rehab is Based on

the Most Innovative Treatment Approaches

Come to The Process Recovery’s Drug and Alcohol Rehab to Detox and Heal

Many of our staff members are in long-term recovery and understand the barriers to finding accessible and effective treatment for drug and alcohol addiction. We are committed to helping you identify and overcome whatever is blocking you from receiving the treatment you need. Our team is passionate about finding the best, customized care plan to support you on your recovery journey.

Substance use has the unfortunate ability to fracture family systems. Even if you’re not the one using substances, the disease can still wield power over your emotional well-being. It can also trigger financial, physical, and interpersonal problems. In a household with active substance use, no one escapes the heartbreaking fallout. However, we have good news. There are many things you can do to increase the overall health of your family unit. Here are just a few:

Seek treatment for your loved one AND your whole family

Give yourself permission to take care of yourself

Take advantage of opportunities to learn more about the disease

Address enabling and codependent behavior

Trusted & Effective

Our integrative and evidence based treatment modalities are proven to yield results. You can enter treatment with peace of

mind and the knowledge that you are receiving the highest calibre of care.

Our Rehab Proudly Serves the New Hampshire Area.

The Process Recovery Center is located in Nashua, New Hampshire and serves clients from the New Hampshire, Massachusetts and Vermont areas. We accept most major insurance providers and also offer an affordable cash pay rate with payment plan options. If you have any questions about our treatment programs or pricing, give us a call or submit the online form.

Life is a journey. Recovery is a process.